Intuit Online Payroll and QuickBooks are two useful business management services. However, each service helps your business in a different way. While Intuit Online Payroll manages the payroll side of your business, QuickBooks handles basic accounting functions. The two payroll software programs work best in complementary roles and are a popular combo for small and medium-sized business owners across the country. Find out how to get free payroll software here for 30 days.

Intuit Online Payroll vs QuickBooks Online How They Help Your Business

Peace of mind: QuickBooks Payroll is the #1 payroll provider for small businesses: Based on the overall number of customers for QB payroll products as of 06/2020. Peace of mind: We help 1.4 million businesses do payroll and file taxes. Account Support. You can also reach out by calling Intuit Phone Support at 1-800-446-8848. Intuit QuickBooks Basic Payroll, Standard Payroll, Enhanced Payroll and Enhanced Payroll for Accountants. Sales (877) 202-0537 Mon-Fri, 6 AM to 6 PM Pacific Time Support We provide multiple support options so you can get assistance when you need it. Go here to get support for Basic, Standard and Enhanced Payroll.

Intuit Online Payroll and QuickBooks help your business in different ways. QuickBooks helps manage the accounting and bookkeeping aspects of your business while Intuit Online Payroll lets you accurately pay employees and assess payroll taxes.

If you need payroll software, Intuit Enhanced Payroll is exactly what you need. Intuit also offers a 30 day free trial and its only $2/ per additional employee.

Benefits of Intuit Online Payroll

Account Support. You can also reach out by calling Intuit Phone Support at 1-800-446-8848.

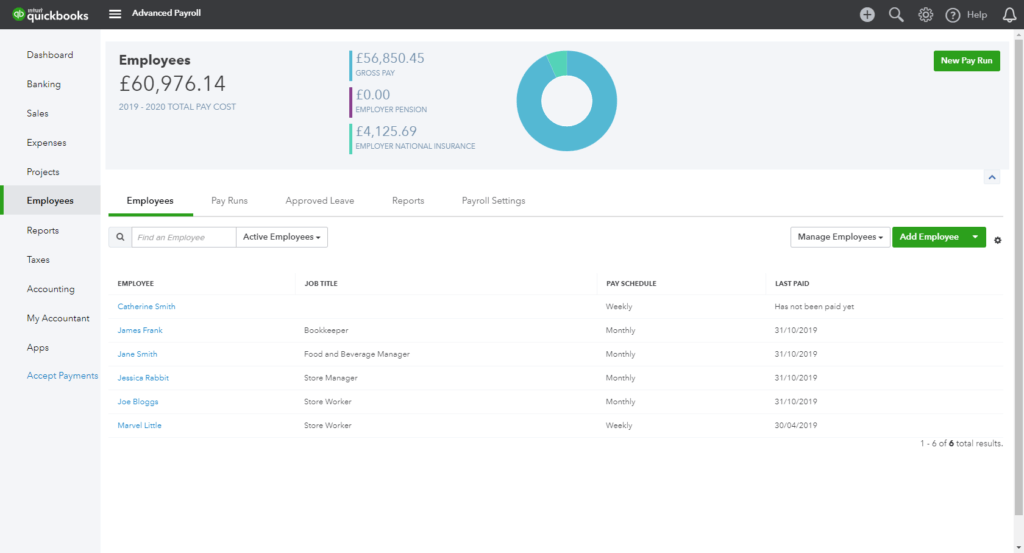

Intuit Online Payroll is a simple but effective payroll software solution. With Intuit Online Payroll, employers can easily pay employees while accurately deducting payroll taxes and other deductions.

Most businesses already use payroll software. However, even if your business already uses payroll software, Intuit’s easy online system may still save time and enhance the accuracy of your business’s payroll system. Here are the ways in which Intuit Online Payroll will help your business:

Create accurate paychecks for employees: Intuit Online Payroll lets you accurately pay employees. You can pay hourly employees, salary employees, and contract employees in just a few simple clicks.

Pay employees: After creating employee paychecks and assessing deductions, Intuit lets you send out payments. You can pay employees via direct deposit or print checks directly from your office printer.

Assess deductions: Payroll taxes are automatically deducted from employee paychecks according to state and federal law. Employers can also create more deductions based on 401(k), stock purchasing plans, and other company-specific policies.

Process W-2s and 1099 forms: The IRS requires a number of forms from your business. Intuit will notify you when W-2s and 1099 forms are due and can process those forms on your behalf.

Tax accuracy guarantee: Like most payroll software solutions, Intuit guarantees that employee paychecks will be processed accurately an on-time.

Benefits of QuickBooks Online

QuickBooks has been a dominant force since the 1990s and was one of the first accounting software programs that let small/medium-sized business owners manage their own accounting without relying wholly on an accountant.

When you subscribe to QuickBooks today, you’re accessing decades of experience and years of knowledge about business services. The benefits of QuickBooks include:

Track income and expenses: QuickBooks Online lets you easily track your business’s income and expenses over defined periods of time.

Bank account synchronization: Synchronize your bank account and credit card accounts to QuickBooks to easily manage and view all business transactions, spent funds, and available funds.

Comprehensive bookkeeping management: QuickBooks is designed to be your business’s one and only bookkeeping service. That’s why it’s loaded with extra features like income and expense tracking, check printing, and many more financial management tools. Not all features are available on all plans, and customers who pay more will receive more bookkeeping features.

Prepare and print 1099s: Not all versions of QuickBooks let you print 1099 forms. 1099 forms are used for reporting payments to contracted employees like consultants and freelance writers. QuickBooks Simple Start and Essentials do not feature 1099 support, but the Plus package does include 1099 support.

Intuit Online Payroll vs QuickBooks Online Supported Services

Mobile apps: QuickBooks offers excellent apps for Android smartphones and tablets as well as iPhones and iPads. Intuit Online Payroll also has apps for Android smartphones and tablets as well as the iPhone, but no iPad app.

Online access: QuickBooks and Intuit Online Payroll can both be accessed online from any internet-connected device. Simply open your browser and login to your account. Downloading apps helps, but it’s not required in order to access your account.

Cloud support: No matter how you access QuickBooks and Intuit, you’re accessing the power of the cloud. All your data is stored on ‘the cloud’, which essentially means you can access it on any internet-connected device.

Compatibility: QuickBooks and Intuit Online Payroll are compatible with one another (the two services are owned by the same company and are designed to complement one another).

Other Points of Comparison On Intuit Online Payroll vs QuickBooks Online

Free Trial: Both Intuit and QuickBooks offer a free trial. Intuit’s free trial lasts for 30 days and requires a credit card. Your credit card will be charged if you forget to cancel your account before the 30 day period is over. QuickBooks does not require a credit card and users also get access to QuickBooks Online Payroll, which is virtually identical to Intuit Online Payroll.

Intuit Payroll Services

Unlimited Use: QuickBooks lets you create unlimited estimates and invoices no matter which plan you choose (Simple Start, Essentials, or Plus). Intuit Online Payroll charges an extra $2 per month for each additional employee.

Extra fees: QuickBooks does not feature extra fees. The monthly charge you see when you choose your plane is the monthly charge you’ll see on your credit card bill. Intuit Online Payroll is honest about its pricing but users will have to pay extra fees for each additional employee ($2 per month per employee) and an extra fee for each state in which taxes need to be filed ($12 per month per state).

Tech Support: Since Intuit and QuickBooks are owned by the same company, tech support is similar. Intuit, however, has a slight edge due to its comprehensive online support options. Intuit Online Payroll users can access an online database filled with FAQs, ‘how to’ videos, and tutorials. If those helpful resources don’t answer your questions, then you can call tech support directly. QuickBooks does not feature the same comprehensive online database but you can contact tech support directly.

Ease of Use: One of the biggest advantages of both QuickBooks and Intuit Online Payroll is their ease of use. Both services are exceptionally easy to use. Whether you’re running a sole proprietorship or a small/medium business with 50 employees, QuickBooks and Intuit Online Payroll never feel overwhelming to use. A lot of time and effort has clearly gone into making the interface as easy as possible to use.

Employee self-reporting: You can give your QuickBooks login information to multiple users – like department managers – who can control their own bookkeeping information. Or, you can pay to add new users to your plan. On Intuit, you can pay an extra fee to have employees report their own hours online for each payroll period, which can save you a considerable amount of time.

Our Verdict On Intuit Online Payroll vs QuickBooks Online

Intuit Online Payroll and QuickBooks are owned by the same company: Intuit. They’re arguably the two most popular business management programs on the market today.

QuickBooks lets you manage your business and view bookkeeping information, while Intuit Online Payroll lets you accurately pay employees and deduct required taxes.

Bookkeeping and payroll taxes are two required parts of doing business in the United States. Some people enjoy calculating payroll taxes on their own, but most people do not.

Ultimately, Intuit Online Payroll will save your business a lot of money and reduce errors. QuickBooks will simplify your bookkeeping while also saving time. The two services work extremely well together and are popular with business owners across the United States.

Intuit Payroll Login

Related Reviews:

Payroll Comparisons:

Intuit Payroll Calculator

How-to Payroll Articles:

Intuit Payroll Services

More Payroll Articles: